Report of Exempt Distribution filings (45-106F1)

FAQs about Report of Exempt Distribution filings originally filed outside SEDAR+

Will my draft report of exempt distribution filings in SEDAR be migrated to SEDAR+?

No, any draft filings in SEDAR will be deleted and will not be migrated to SEDAR+.

Can I amend a report of exempt distribution in SEDAR+ that was filed in SEDAR?

Yes, you should search for the report originally filed in SEDAR and select it from the search result and click on ‘Actions’ to amend the existing filing. You will need to enter the data in each of the attributes of the amended report of exempt distribution form, instead of attaching a completed PDF form. Data will not be pre-populated from the original report of exempt distribution filing. You will also need to upload a completed Schedule 1 in XLSX format using the CSA’s Excel template (To access the template, refer to < What format must I use to file Report of Exempt Distribution (Form 45-106F1) and its associated schedules on SEDAR+? >.) Schedule 2 is completed by entering the data directly into the system instead of uploading an XLSX file.

Why can’t I find my report of exempt distribution filing in SEDAR+?

If the filing was originally filed in paper only, it will not be available in SEDAR+. If the report of exempt distribution filing was filed only through the OSC Electronic Filing Portal and/or BCSC eServices and it was not filed in SEDAR, then the report will also not be available in SEDAR+.

How do I submit an amendment to a report of exempt distribution that I submitted in the BCSC e-Services, the OSC Electronic Filing Portal and/or paper format and not on SEDAR?

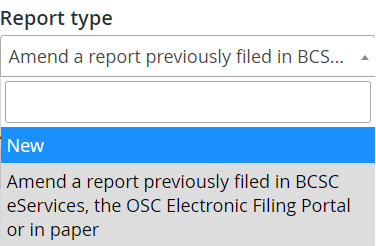

A report of exempt distribution filing submitted through the BCSC e-Services, the OSC Electronic Filing Portal or paper format will not appear in SEDAR+. If you need to amend a previous filing, please follow the steps below:

- Enter the filing as a new filing in SEDAR+

- When choosing the Report Type, which is Item 1 in the Report, select ‘Amend a report previously filed in BCSC eServices, the OSC Electronic Filing Portal or paper’

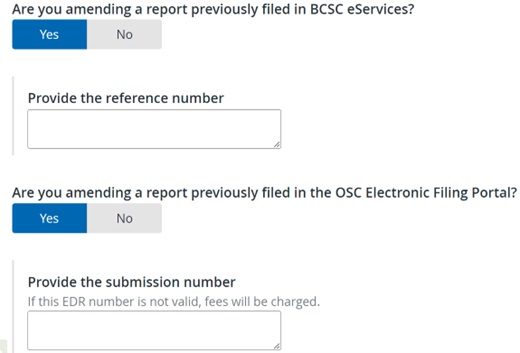

- Provide a reference number (BC) or EDR number (Ontario) when prompted. Entering a valid reference or EDR number will ensure you will not be charged again for this filing.

If you are amending a Form 45-106F1 previously filed via OSC’s e-portal, a valid EDR# must be provided. Please ensure it is entered correctly. Otherwise, fees may apply.

If you do not know your reference number, go to Manage your reports in the BCSC eServices portal, log in with your username and password, and find the submission you want to reference. If you do not know your EDR number, please refer to the OSC’s Exempt Distributions Summary.

Continue to complete the filing with the required changes.

How do I file an amended report of exempt distribution filing if my original filing was filed on SEDAR and the BCSC e-Services or the OSC Electronic Filing Portal?

Search for the report originally filed in SEDAR and select it from the search result to amend the filing. Add British Columbia and Ontario as recipient agencies, as applicable. For more information on amending a report of exempt distribution filed on SEDAR, refer to <Can I amend a report of exempt distribution in SEDAR+ that was filed in SEDAR?>.

It is important not to amend a report that was filed in SEDAR and one or both of BCSC e-Services and OSC Electronic Filing Portal by creating a new filing in SEDAR+. Creating a new filing in SEDAR+ when the original filing was made in SEDAR and BCSC e-Services and/or OSC Electronic Filing Portal will result in the system overcharging the report fees and duplicating the information.

Regulatory authorities filing guidance

Is there any guidance provided by the Canadian Securities Administrators (CSA) about preparing and filing reports of exempt distribution?

Yes. For more information on the report of exempt distribution, including guidance on completing and filing the report of exempt distribution, click on the following external links to staff notices or any updates thereto:

- CSA Staff Notice 45-308 (Revised) Guidance for Preparing and Filing Reports of Exempt Distribution under National Instrument 45-106 Prospectus Exemptions

- CSA Staff Notice 45-325 Filing Requirement and Fee Payable for Exempt Distributions involving Fully Managed Accounts

- Instructions for preparing Form 45-106F1 Report of Exempt Distribution

- Companion Policy 72-503CP Distributions of Securities outside British Columbia

- Companion Policy 72-503CP Distributions Outside Canada

- Companion Policy 72-501CP Distributions to Purchasers Outside Alberta

- Companion Policy to Local Rule 72-501 Distribution of Securities to Persons Outside New Brunswick

Which securities regulatory authorities have answers to frequently asked questions pertinent to report of exempt distribution filings in their jurisdiction?

- For the British Columbia Securities Commission’s (BCSC) frequently asked questions about reports of exempt distribution, click on the following link to their site Exempt Distributions FAQ.

- See also the frequently asked questions in CSA Staff Notice 45-308 (Revised) Guidance for Preparing and Filing Reports of Exempt Distribution under National Instrument 45-106 Prospectus Exemptions

General

When a principal regulator is selected for a report of exempt distribution (Form 45-106F1), will filing fees apply to the principal regulator and will the principal regulator receive the filing?

The system fee will be allocated to the principal regulator, however, filing fees and any late fees would only apply based on the recipient agencies selected, as applicable. Similarly, the principal regulator would not receive the report and supporting documentation unless selected as a recipient agency.

Will a report of exempt distribution and other exempt market offerings filings continue to be filed through separate local and national systems?

No. SEDAR+ includes the ability to file a report of exempt distribution and other exempt market offerings filings in every jurisdiction in Canada through a single submission, instead of requiring filers to make the same filing through multiple systems.

In what order should I file a report of exempt distribution and all its related filings on SEDAR+?

You should start by filing all related exempt market filings, such as an offering memorandum or marketing materials, where applicable. Then, you should create a report of exempt distribution and reference the related filings. If you already have started the creation of a report of exempt distribution without having made the related filings, you can save it as a draft, make all related filings and return to the draft to finalize the creation of the report of exempt distribution.

Note: Item 7h is no longer required in the new form used on SEDAR+, as there are new filing types in SEDAR+:

- ‘Offering memorandum (2.9 of NI 45-106F1)’ and

- ‘Offering memorandum (other than 2.9 of NI 45-106F1)’

If you need to submit an Offering memorandum (OM) in reference to a RED filing, submit that document as a separate filing in SEDAR+ and then add it as a referenced document to the Report of Exempt Distribution (RED) filing.

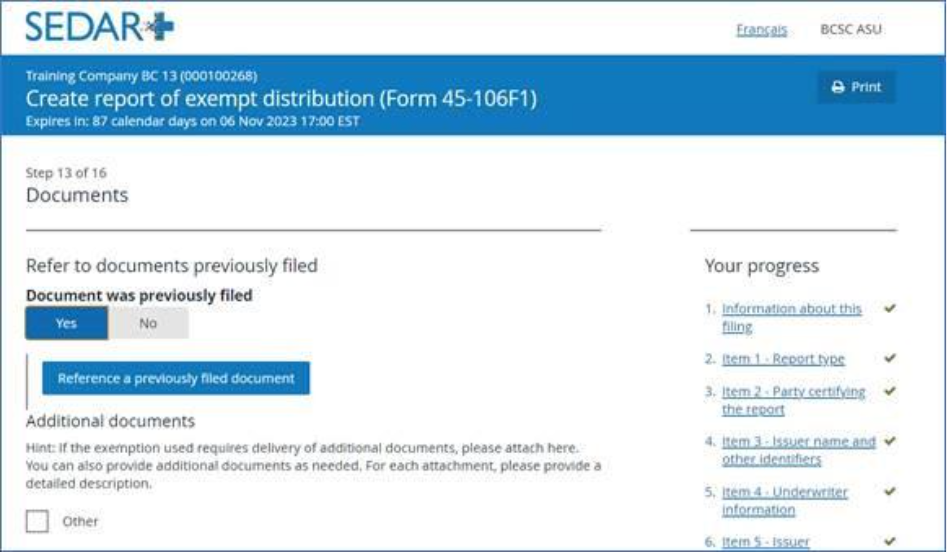

Which documents can I reference as a previous filing in my Report of Exempt Distribution?

The following table provides a list of the exempt market offerings filing types, associated sub-types and document types you are able to reference as a previous filing in your report of exempt distribution.

When you reach step 13 of the RED filing, select ‘Yes’ under ‘Document was previously filed’ and click on ‘Reference a previously filed document’. This will give you a list of the Offering Memorandums you have filed in the system.

| Filer Category | Filing Type | Filing Sub-type | Document |

|---|---|---|---|

| Investment Fund | Offering Memorandum (2.9 of NI 45-106) | Offering Memorandum (2.9 of NI 45-106) | Offering memorandum (2.9 of NI 45-106) – English |

| Offering memorandum (2.9 of NI 45-106) – French | |||

| Undertaking | |||

| Investment Fund | Offering Memorandum (2.9 of NI 45-106) | Amended Offering Memorandum (2.9 of NI 45-106) | Offering memorandum (2.9 of NI 45-106) (amended) – English |

| Offering memorandum (2.9 of NI 45-106) (amended) – French | |||

| Investment Fund | Marketing Materials (2.9 of NI 45-106) | Marketing Materials (2.9 of NI 45-106) | Marketing materials related to offering memorandum – English |

| Marketing materials related to offering memorandum – French | |||

| Amended Marketing Materials (2.9 of NI 45-106) | Marketing materials related to offering memorandum (amended) – English | ||

| Marketing materials related to offering memorandum (amended) – French | |||

| Company | Offering Memorandum (2.9 of NI 45-106) | Offering Memorandum (2.9 of NI 45-106) | Voluntary Pre-filing of Draft Offering Memoranda (NB Local Staff Notice 45-701) |

| Voluntary Pre-filing of Draft Offering Memoranda (SK Local Staff Notice 45-706) | |||

| Offering memorandum (2.9 of NI 45-106) – English | |||

| Offering memorandum (2.9 of NI 45-106) – French | |||

| Technical report (NI 43-101) – English | |||

| Technical report (NI 43-101) – French | |||

| Amended & restated technical report (NI 43-101) – English | |||

| Amended & restated technical report (NI 43-101) – French | |||

| Undertaking | |||

| Company | Offering Memorandum (2.9 of NI 45-106) | Amended Offering Memorandum (2.9 of NI 45-106) | Offering memorandum (2.9 of NI 45-106) (amended) – English |

| Offering memorandum (2.9 of NI 45-106) (amended) – French | |||

| Technical report (NI 43-101) – English | |||

| Technical report (NI 43-101) – French | |||

| Amended & restated technical report (NI 43-101) – English | |||

| Amended & restated technical report (NI 43-101) – French | |||

| Company | Marketing Materials (2.9 of NI 45-106) | Marketing Materials (2.9 of NI 45-106) | Marketing materials related to offering memorandum – English |

| Marketing materials related to offering memorandum – French | |||

| Amended Marketing Materials (2.9 of NI 45-106) | Marketing materials related to offering memorandum (amended) – English | ||

| Marketing materials related to offering memorandum (amended) – French | |||

| Real Estate Offering Document | Real estate offering document – English | ||

| Real Estate Offering Document | Real estate offering document – French | ||

| Amended Real Estate Offering Document | Real estate offering document (amended) – English | ||

| Real estate offering document (amended) – French | |||

| Investment Fund | Offering Memorandum (Other than 2.9 of NI 45-106) *See Note below table | Offering Memorandum (Other than 2.9 of NI 45-106) | Offering memorandum (other than 2.9 of NI 45-106) – English |

| Offering memorandum (other than 2.9 of NI 45-106) – French | |||

| Offering memorandum (other than 2.9 of NI 45-106) (amended) – English | |||

| Offering memorandum (other than 2.9 of NI 45-106) (amended) – French | |||

| Company | Offering Memorandum (Other than 2.9 of NI 45-106) *See Note below table | Offering Memorandum (Other than 2.9 of NI 45-106) | Offering memorandum (other than 2.9 of NI 45-106) – English |

| Company | Offering Memorandum (Other than 2.9 of NI 45-106) | Offering Memorandum (Other than 2.9 of NI 45-106) | Offering memorandum (other than 2.9 of NI 45-106) – French |

| Offering memorandum (other than 2.9 of NI 45-106) (amended) – English | |||

| Offering memorandum (other than 2.9 of NI 45-106) (amended) – French | |||

| Company | NB LR 45-509 – Community Economic Development Corporations and Associations (CEDC) Economic Development Corporations and Associations | Offering Document | CEDC offering document of Form 45-509F1 |

| Amended Offering Document | CEDC offering document of Form 45-509F1 (amended) | ||

| Promotional Material | CEDC promotional material | ||

| Amended Promotional Material | CEDC promotional material (amended) | ||

| Certificate of Registration | CEDC certificate of registration | ||

| Letter of Non-Objection | CEDC letter of non-objection | ||

| Notice of Surrendering or Revocation | CEDC notice of surrender or revocation of registration | ||

| Notice of Specified Events | CEDC notice of specified events – Form 45-509F4 | ||

| Notice of Specified Events Specified Events | CEDC notice of specified events – Form 45-509F4 (amended) | ||

| Offering Document | CEDC offering document of Form 45-509F1 | ||

| Investment Fund | NB LR 45-509 – Community Economic Development Corporations and Associations (CEDC) Economic Development Corporations and Associations | Amended Offering Document | CEDC offering document of Form 45-509F1 (amended) |

| Promotional Material | CEDC promotional material | ||

| Amended Promotional Material | CEDC promotional material (amended) | ||

| Certificate of Registration | CEDC certificate of registration | ||

| Letter of Non-Objection | CEDC letter of non-objection | ||

| Notice of Surrendering or Revocation | CEDC notice of surrender or revocation of registration | ||

| Notice of Specified Events | CEDC notice of specified events – Form 45-509F4 | ||

| Notice of Specified Events | CEDC notice of specified events – Form 45-509F4 (amended) | ||

| Company | Report of Trade | Report of Trade | Report of trade |

| Company | Start-Up Crowdfunding – Offering Document | Start-Up Crowdfunding – Offering Document | Offering document – English |

| Offering document – French | |||

| Amended Start-Up Crowdfunding – Offering Document | Offering document (amended) – English | ||

| Offering document (amended) – French | |||

| Company | Crowdfunding – Offering Document (MI 45-108) | Crowdfunding Offering Document (MI 45-108) | Crowdfunding offering document (MI 45-108) – English |

| Crowdfunding offering document (MI 45-108) – French | |||

| Other distribution materials (MI 45-108) – English | |||

| Other distribution materials (MI 45-108) – French | |||

| Amended Crowdfunding – Offering Document (MI 45-108) | Crowdfunding offering document (MI 45-108) (amended) – English | ||

| Crowdfunding offering document (MI 45-108) (amended) – French | |||

| Other distribution materials (MI 45-108) (amended) – English | |||

| Other distribution materials (MI 45-108) (amended) – French | |||

| Investment Fund | News Releases | News Releases | News release – English |

| News release – French | |||

| Company | News Releases | News Releases | News release – English |

| News release – French | |||

| Offering material – English | |||

| Offering material – French | |||

| Company | Listed Issuer Financing Exemption – Offering Document | Listed Issuer Financing Exemption – Offering Document | Offering document – English |

| Offering document – French | |||

| News release – English | |||

| News release – French | |||

| Amended Listed Issuer Financing Exemption – Offering Document | Offering document (amended) – English | ||

| Offering document (amended) – French | |||

| News release – English | |||

| News release – French | |||

| Company | Start-up crowdfunding – offering document (NI 45-110) | Start-up crowdfunding – offering document (NI 45-110) | Offering document – English |

| Offering document – French | |||

| Amended start-up crowdfunding – offering document (NI 45-110) | Offering document (amended) – English | ||

| Offering document (amended) – French |

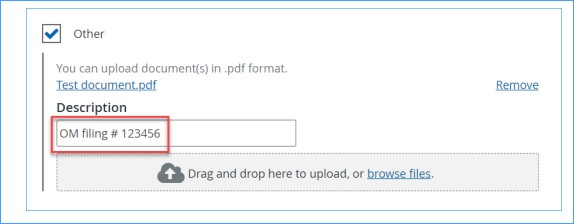

Note: If the offering memorandum filed was an ‘Offering memorandum (Other than 2.9 of NI 45-106)’, a workaround is required as documents submitted under this filing type are currently not searchable.

Workaround instructions: Select the document type ‘Other’ and attach a PDF document that indicates the filing number for the ‘Offering memorandum (Other than 2.9 of NI 45-106)’. The filing number can also be entered in the ‘Description’ field.

What format must I use to file Report of Exempt Distribution (Form 45-106F1) and its associated schedules on SEDAR+?

The body of Form 45-106F1 Report of exempt distribution must be filed by entering the data directly into a SEDAR+ webform.

Schedule 1 of Form 45-106F1 must be filed in .xlsx format using this Excel template developed by the CSA.

Schedule 2 of Form 45-106F1 will be auto generated in SEDAR+ based on information entered in Item 9, as applicable.

Read: NI 45-106 F1 Item 9 Scenarios Guide, which provides Reports of Exempt Distribution filing scenarios and details on how the information displays on SEDAR+, on the generated Form 1 and Schedule 2.

How do I generate the Report of Exempt Distribution (Form 45-106F1) including schedule 2 of Form 45-106F1 in another language?

Form 45-106F1 including schedule 2 of Form 45-106F1 can be generated in both English and French. When requesting to complete these forms, the system will generate them in the preferred language indicated in your user account. If you wish to submit the Form 45-106F1 in another language, you will need to modify your language preference by updating your user account. To do so, click on ‘My user details’ at the top right corner of the screen. Once modified, the system will generate the forms in your new language of preference.

Can I file a report of exempt distribution for an investment fund group profile?

A report of exempt distribution cannot be filed against an investment fund group profile. If you file a report for an investment fund that belongs to a group, the report must be filed through the investment fund profile.

How do I file a Report of Exempt Distribution (Form 45-106F1) if I am relying on sections 4, 5 or 6 of Alberta local rule 72-501 (ASC Rule 72-501) and another reportable exemption within the same 10 day period?

You will need to file two separate reports of exempt distribution on SEDAR+; one reporting reliance on sections 4, 5 or 6 of ASC Rule 72-501 and one reporting reliance on the other reportable exemption(s).

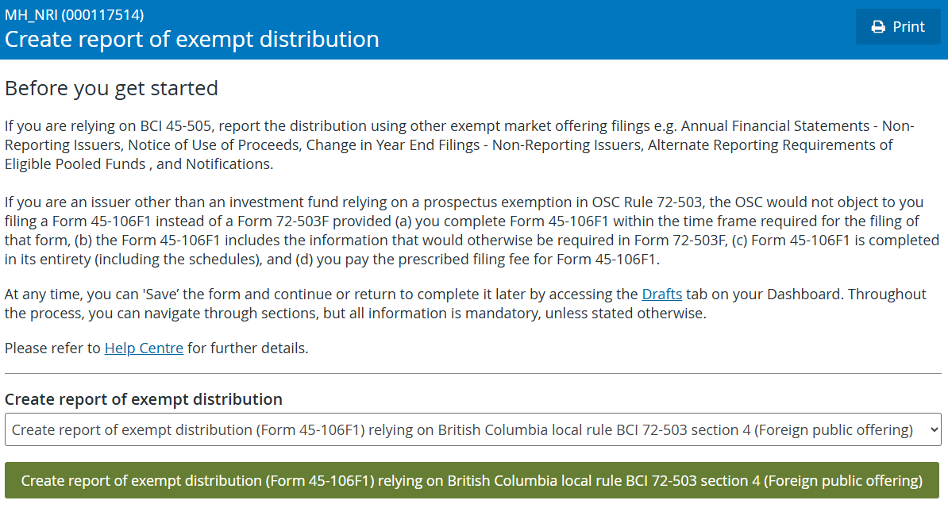

How do I file a Report of Exempt Distribution (Form 45-106F1) if I am relying on section 4 of BC Instrument 72-503 (BCI 72-503) and another reportable exemption within the same 10 day period?

You will need to file two separate reports of exempt distribution on SEDAR+; one reporting reliance on section 4 of BCI 72-503 (that does not require a Schedule 1 to be attached) and one reporting reliance on the other reportable exemption(s).

Note: The reporting status on the issuer’s profile must indicate ‘No’ for the green tab to display to initiate the filing.

If the issuer is a reporting issuer, select the ‘Report of exempt distribution (Form 45-106F1)’ filing type option. When asked for the exemption relied in item 7f), select ‘Other’ and enter ‘BCI 72-503’. Attach a blank Schedule 1 and add an explanation indicating the report pertains to a reporting issuer.

Which value should I use for clause (e)1 of Schedule 1 if I am relying on the accredited investor exemption for a distribution in Ontario?

If the issuer relies on the accredited investor prospectus exemption in section 73.3(2) of the Securities Act (Ontario) for a distribution in Ontario, select the value ‘NI 45-106 2.3 [Accredited Investor]’.

Which value should I use for item 7(f) of the web form and clause (e)1 of Schedule 1 if I am relying on the family, friends and business associates prospectus exemption for a distribution in Ontario?

If the issuer relies on section 2.6.1 of NI 45-106 for a distribution in Ontario, select the value ‘NI 45-106 2.5 [Family, friends and business associates]’.

Which value should I use for item 7(f) of the web form and of Schedule 1 if I am relying on BCI 72-503 section 3, ASC Rule 72-501, and NB Local Rule 72-501 for distributions outside of the jurisdiction that does not trigger a separate filing?

If the issuer is relying on the local jurisdiction’s ‘distribution out’ exemption, select ‘Distribution to purchasers outside local jurisdiction (BC, AB, NB)’.

What are the character limits for total dollar amounts in item 7(f) of the web form?

- Total dollar amount (Canadian $):

- Max 13 characters including decimal, 2 digits after the decimal; Format: $ 9, 999, 999, 999.99

- Total dollar amount of securities distributed:

- Max 20 characters, including decimal, 4 digits after the decimal; Format: 000,000,000,000,000.0000

Generate, Review, Edit reports

Can I view the report of exempt distribution (Form 45-106F1) and Schedule 2 prior to submission?

Yes. Form 45-106F1 and Schedule 2 can be generated prior to submission. Select ‘Review generated documents’ on the draft filing, then click on ‘Generate documents’. The system will generate both forms and provide a link to each that you can click to download the draft forms for review. Read ‘How can I generate draft report of exempt distribution document(s) that can be changed prior to submission?’ for information on how to edit the reports once the documents are generated.

How can I generate draft report of exempt distribution document(s) that can be changed prior to submission?

On step 15 ‘Review and submit’, select ‘Save and continue’ to proceed to step 16 ‘Review generated documents’. Select the box to generate the documents and then select ‘Generate documents’. Click on the generated forms to download for review. Select ‘Exit’ (Do Not click ‘Submit’ or ‘Save’). Click on the SEDAR+ logo to return to your dashboard where you can reopen the filing from your Drafts list. Make your changes by going to the ‘Review and submit’ section. Then regenerate the document(s) and proceed to submit your filing.

Amend filing

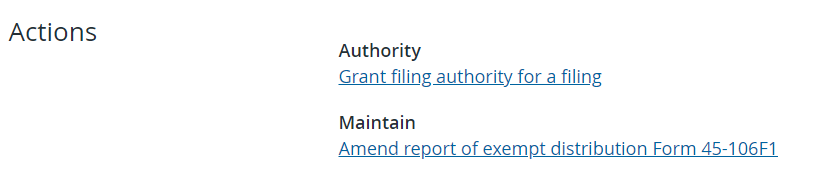

How do I amend a Report of Exempt Distribution (Form 45-106F1) or Report of Distribution Outside of Canada (Form 72-503F) submitted within SEDAR+?

View the existing filing that you want to amend. Within the ‘Filing details’ tab, select the latest ‘Submission number’ of the filing and you will be redirected to ‘View Submission Details’. Navigate to the ‘Actions’ section at the bottom of this page to amend the filing. Please refer to the screenshot below:

All prepopulated data from the existing filing must be validated before submitting the amended report.

Non-reporting issuers

Why is a non-reporting issuer being asked to identify a principal regulator when filing a report of exempt distribution (Form 45-106F1)?

It is necessary to identify a principal regulator to ensure that the system fee for the report of exempt distribution is allocated to that jurisdiction.

How do I determine the principal regulator for a non-reporting issuer when filing a report of exempt distribution (Form 45-106F1)?

The principal regulator should be determined using the same principles as in Multilateral Instrument 11-102 Passport System.

Underwriter filings

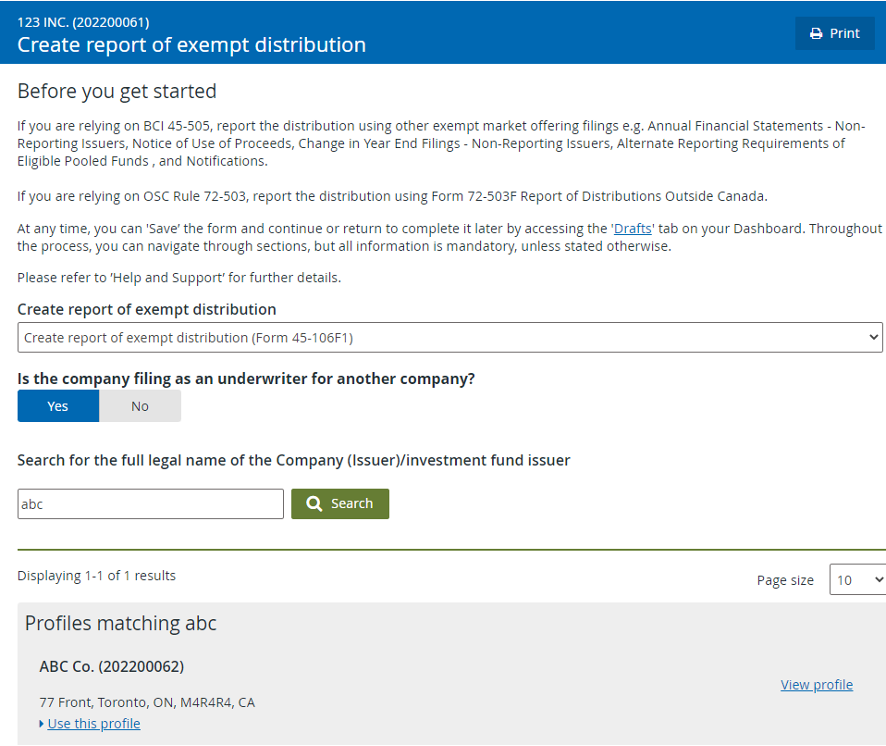

When filing a report of exempt distribution do I need authority over the issuer profile when filing as an underwriter?

No. When creating a report of exempt distribution filing with either a company or third party profile that indicates the filer is an underwriter, the system will ask if you are filing as an underwriter on behalf of another. Select ‘Yes’, search for the issuer and select ‘Use this profile’.

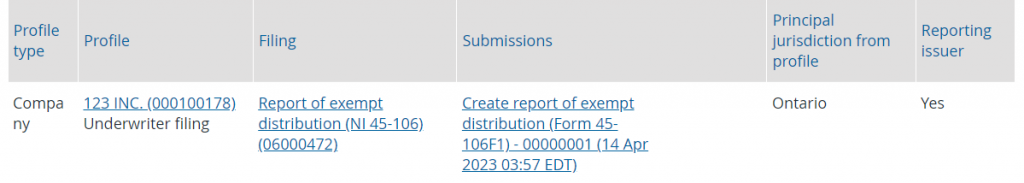

Will a report of exempt distribution certified by an underwriter be applied to both the underwriter and issuer profiles?

Yes. The report of exempt distribution filing will appear on both the issuer profile and the underwriter profiles. A search for the filing will only return one instance of the filing and will include the text ‘underwriter filing’ below the filing link.

How can I file a report of exempt distribution as an underwriter, if I am unable to find the issuer in SEDAR+?

You must contact the issuer and ask them to create a profile in SEDAR+.

How do I submit a Report of Exempt Distribution (Form 45-106F1) as an underwriter?

Navigate to the underwriter’s profile to create the new filing. On the ‘Before You Get Started’ page, search for the issuer profile for which the filing will be made. You do not need to have authority over the issuer profile that you are selecting. Ensure that the information on the underwriter’s profile is accurate, as certain fields from the profile will prepopulate as read-only into the ‘underwriter’ section of the filing. The filing will be available on your (i.e. the underwriter’s) profile in addition to the issuer’s profile.

Fee attributes

In Québec, what gross value of securities distributed do I need to enter in the “Fee attributes” section when I am filing a report of exempt distribution, and the securities distributed were purchased on behalf of fully managed accounts?

In Québec, the gross value of securities distributed to beneficial owners located in Québec is considered in the fee calculation. For a correct system calculation of fees payable in Québec, you will need to enter the total gross value of securities distributed in Québec, which is comprised of:

- the total amount of securities distributed in Québec, under any exemption, already entered in item 7f) of the report of exempt distribution “Information about the distribution”

- the total amount of securities distributed to beneficial owners located in Québec when the securities were purchased on behalf of fully managed accounts.

Last updated on: January 19, 2026