Fees

General

Do I have to pay fees to submit filings?

Yes. If a filing is subject to system or regulatory fees, you will not be able to submit the filing without paying those fees.

What is an outstanding fee, and how do I pay it?

An outstanding fee is created by a securities regulatory authority or the operator in SEDAR+ when there is a fee owing on a filing that has already been submitted. This could happen, for example, if a filer’s payment did not process, if incorrect information was entered at the time of filing or if there was a system issue. Outstanding fees should be paid promptly. For more information, refer to Search filings with outstanding fees and Pay outstanding fees.

Will adding a recipient agency to an existing filing result in additional fees?

Additional fees may be payable when recipient agencies/ jurisdictions are added to an existing filing. For example, when new jurisdictions are added to a filing, filers will have to pay fees for those new jurisdictions.

An update to the SEDAR+ fee logic is required to recognize that a jurisdiction was added to a filing when no document(s) is attached.

An outstanding fee will be created by the regulator for payment on the filing after submission until SEDAR+ is updated. An email will be sent by the regulator regarding the outstanding fee.

I’m submitting a revised document because my previous submission was incorrect. Will I have to pay an additional fee?

To avoid paying an additional fee when correcting an error in a filed document you need to search for and use its existing Grouping ID. For more information about Grouping IDs, read What is a document Grouping ID and why is it used?

Do I have to pay filing fees for documents incorporated by reference?

A filing fee is charged, where applicable, at the time a document is first submitted into the system. If the same document is then later incorporated by reference into another filing, an additional fee is not charged as a result of the incorporation by reference.

The only time additional fees will be charged is if recipient agencies are added to the original filing which contains the document being incorporated by reference in a separate filing (e.g., prospectus).

I have created a prospectus filing under the wrong filing type. Can the fees from that filing be transferred to a new filing that will be made under the correct filing type?

No, the previously paid fees cannot be transferred. Notify the principal regulator of the prospectus filing – the principal regulator will contact the CSA Service Desk to request that fee exception codes are created for each applicable recipient agency. The CSA Service Desk will then provide you with the fee exception codes, including a system fee exception code, which can be entered when the new filing is created under the correct filing type.

What is an OSC unique identifier number and how do I obtain it?

If you are an issuer, underwriter or investment fund and you have accrued historical late document fees in respect of late Form 45-106F1 submissions in Ontario, you will have been assigned an OSC unique identifier number. This number was provided to the most recent filing contact person as part of the Onboarding process. Generally, adding the OSC unique identification number to the profile will take into account certain historical late document fees applied to late 45-106F1s submitted on the OSC’s electronic filing portal which may affect the annual fee cap. You can add this number under the company or investment fund identification heading using the ‘Maintain profile’ functionality. Failure to enter this number on the profile may result in duplicative late document fees in SEDAR+, if applicable.

If you have accrued late document fees relating to late 45-106F1 filings submitted on the OSC Portal, contact the CSA Service Desk listed on the SEDAR+ Contact Us page to obtain your OSC unique identifier number.

Will the filing be accepted by the securities regulatory authority(s) upon payment submission or only once the EFT payment is confirmed?

Yes, the filing will be accepted upon filing submission. If the payment is subsequently not cleared by your financial institution, an outstanding fee will be applied against the filing for re-payment.

Fee exceptions

What is a fee exception and how do I request a fee exception code?

A fee exception code is a one-time use code that is entered at the time of filing and allows the filer to submit a filing without paying a system fee or regulatory fee in a particular jurisdiction. If a regulatory fee is owed in multiple jurisdictions, a code will be required for each jurisdiction. The fee exception code(s) is(are) obtained from the CSA Service Desk or the respective recipient agency, as indicated in the table above. A fee exception code is granted upon request if the fee is calculated incorrectly by the system, or a fee is not owed by the filer for the filing that is being made. When a fee is owed but a fee exception code is used to avoid a fee calculation error, the filer will need to return to the system and pay the correct outstanding fee after it has been created by the recipient agency.

When should I contact the CSA Service Desk for fee exception codes and what process should I follow?

The information provided below explains how to request fee exception codes. Also refer to How do I enter a fee exception code? and If I am using a fee exception code, do I still need to complete the fee attributes section?

To request a system fee exception code:

You should contact the CSA Service desk (see contact information below) if you require a system fee exception code. To obtain a system fee exception code, send an email to the CSA Service Desk and include:

If the request is approved, the CSA Service Desk will send you a reply that includes the system fee exception code.

the following information in the subject line of the email: Subject: Request for SEDAR+ system fee exception code – <Enter impacted filing type>

include the “Fee Exception Code Request Table” provided below. Please copy and paste this table into your fee exception code email request and complete all the information. Also attach any relevant screenshots (e.g. fee summary page, filing confirmation page, error messages).

To request a regulatory fee exception code for a single jurisdiction (for any one filing):

You should contact the recipient agency (see contact information below) for a regulatory fee exception code if you require a regulatory fee exception code only from a single jurisdiction.To obtain the regulatory fee exception code, send an email to the recipient agency and include:

- the following information in the subject line of the email: Subject: Request for SEDAR+ regulatory fee exception code – <Enter impacted filing type>

- include the “Fee Exception Code Request Table” provided below. Please copy and paste this table into your fee exception code email request and complete all the information. Also attach any relevant screenshots (e.g. fee summary page, filing confirmation page, error messages).

- If the request is approved, the recipient agency will send you a reply that includes the regulatory fee exception code.

To request regulatory fee exception codes for multiple jurisdictions (for any one filing):

You should contact the CSA Service desk (see contact information below) for fee exception codes if you require fee exception codes from multiple jurisdictions for the same filing. The CSA Service Desk will send you fee exception codes for all applicable jurisdictions in a single email. To obtain the fee exception codes, send an email to the CSA Service Desk and include:

- the following information in the subject line of the email: Subject: Request for SEDAR+ regulatory fee exception code –

- include the “Fee Exception Code Request Table” provided below. Please copy and paste this table into your fee exception code email request and complete all the information. Also attach any relevant screenshots (e.g. fee summary page, filing confirmation page, error messages).

- If the request is approved, the CSA Service Desk will send you a reply that includes fee exception codes for each requested jurisdiction.

- Where the request is for an Investment Fund Group, please send one email only for the filing. A separate email is not required for each fund within the filing.

Fee Exception Code Request Table:

Please complete all questions and attach any relevant screenshots (e.g. fee summary page, filing confirmation page, error messages)

| 1. Profile name (the name of the profile used to create the filing as shown on the blue banner) | |

| 2. Profile number | |

| 3. Profile type (Company, Investment Fund, Investment Fund Group, Third Party) | |

| 4. Filing number | |

| 5. Filer contact name(s) | |

| 6. Filer email address(es) | |

| 7. Filing type (see Filing Inventory for a list of Filing types) | |

| 8. Filing sub type (see Filing Inventory for a list of Filing sub types) | |

| 9. Applicable jurisdictions for which a fee exception is required (this MIGHT NOT INCLUDE ALL the recipient agencies associated with the filing) | |

| 10. Is a fee exception code required for the Systems Fee? (Yes or No) | |

| 11. Reason for request including additional details about your filing that will help to explain what fees should be charged Examples: Unexpected fee discrepancies (e.g. higher than expected fee charges)Technical issues that prevent you from filing in a timely manner Onboarding challenges or profile setup issues Filing a previously filed Participation Fee Form Filing a document previously filed outside of SEDAR+ Filing created or maintained with fees paid but the submission didn’t go through | |

| Do you have an open ticket with the Service Desk? If yes, what is the ticket number? | |

| Did you contact the Service Desk with a related technical issue and not receive a ticket number? If yes, please provided details (e.g. provide date(s) and/or copy of email(s))? | |

| If there is a late fee applicable, when is your filing due date? |

What contact information should I use to contact the CSA Service Desk or the recipient agency for fee calculation errors?

CSA Service Desk contact information and hours of operation:

| CSA Service Desk | Hours of Operation |

| Toll Free (Within North America): 1-800-219-5381 Outside of North America: 1-514-878-8377 Email: sedarplus@csa-acvm.ca | Monday – Friday: 7:00 am to 11:00 pm ET (excluding Canadian statutory holidays) |

Recipient agency contact information:

| Recipient Agency | Email Address |

| Alberta Securities Commission (ASC) | Prospectus filings and pre-files: Prospectus.Reviews@asc.ca Report of Exempt Distribution (for both Companies + Investment funds): accounts.receivable@asc.ca |

| Autorité des marchés financiers (AMF) | droitslvm@lautorite.qc.ca |

| British Columbia Securities Commission (BCSC) | finreport@bcsc.bc.ca |

| Financial and Consumer Affairs Authority of Saskatchewan (FCAA) | corpfin@gov.sk.ca |

| Financial and Consumer Services Commission (FCNB) | passport-passeport@fcnb.ca |

| Service Newfoundland & Labrador – Office of the Superintendent of Securities (NL-Gov) | SecuritiesExemptions@gov.nl.ca |

| Manitoba Securities Commission (MSC) | securities@gov.mb.ca |

| Nova Scotia Securities Commission (NSSC) | NSSC_Corp_Finance@novascotia.ca |

| Office of the Superintendent of Securities (NWT-Gov) | Elizabeth_Doyle@gov.nt.ca Shmaila_nosheen@gov.nt.ca |

| Office of the Superintendent of Securities – Prince Edward Island (PE-Gov) | ccis@gov.pe.ca |

| Office of the Superintendent of Securities for Nunavut (NU-Gov) | securities@gov.nu.ca |

| Ontario Securities Commission (OSC) | For Investment Funds: OSC_IFSP_Fees@osc.gov.on.ca For Companies: OSC_CF_Fees@osc.gov.on.ca |

| Office of the Yukon Superintendent of Securities (YT-Gov) | Securities@Yukon.ca |

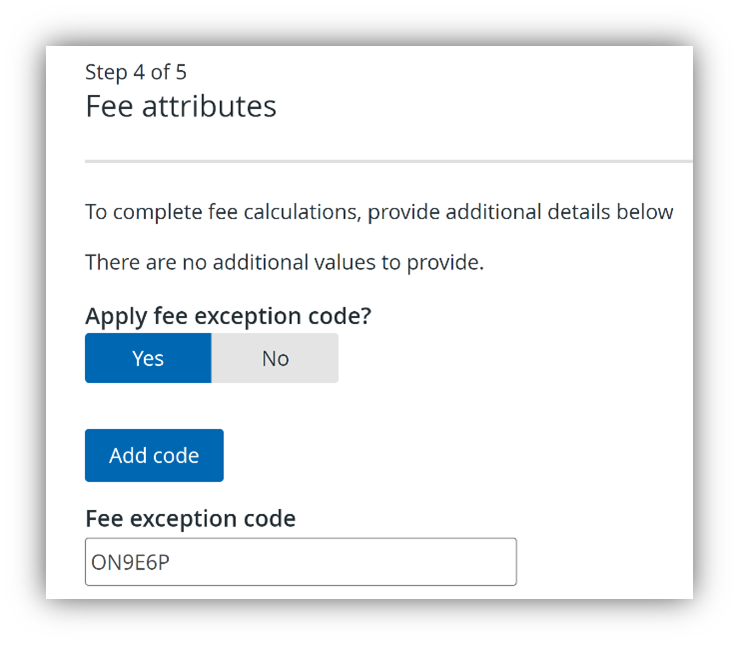

How do I enter a fee exception code?

Before submitting a filing, SEDAR+ provides a ‘Fee attributes’ page where you will enter the code. Note: this field will only display if fee exception code(s) have been created for the issuer.

- Enter a fee exception code for each jurisdiction where the fee calculation issue applies. Select ‘Add code’ to add more exception codes to a filing. System fee exceptions will have their own code.

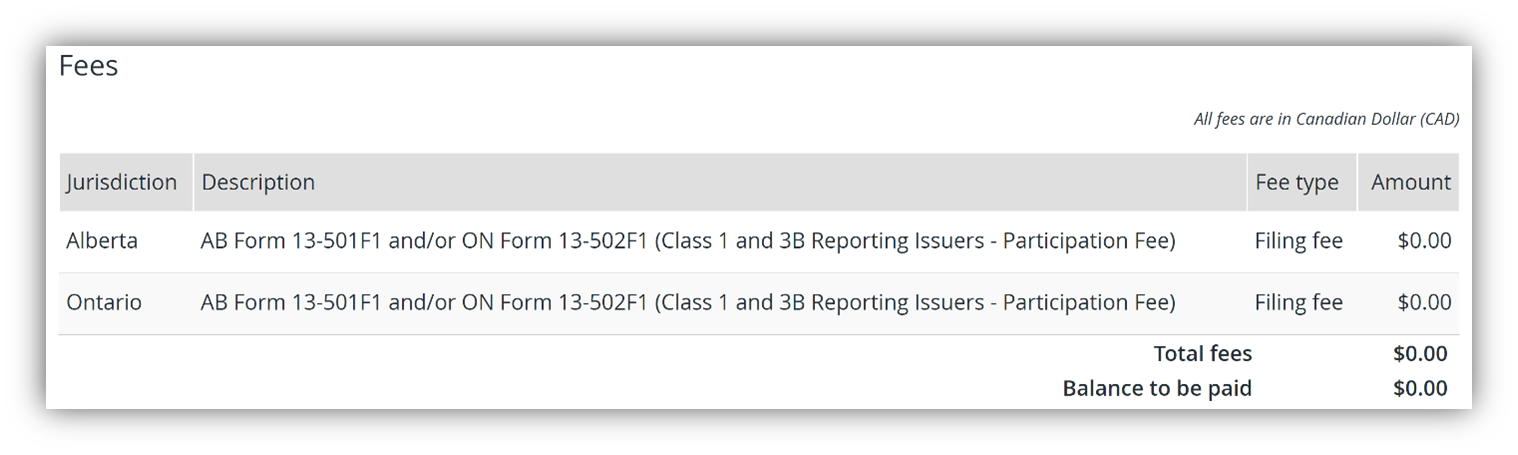

- Click save and move to the Fee summary and payment page. You will see that the Amount is ‘$0.00’ in the fee breakdown against the jurisdictions that have a code entered for them.

If I am using a fee exception code, do I still need to complete the fee attributes section?

Yes, all fee attribute information must still be filled in completely and accurately unless you have been provided specific direction, by one of the securities regulatory authorities, to do otherwise.

Pre-filings

In Ontario, what fees are required with a pre-filing related to an application or prospectus?

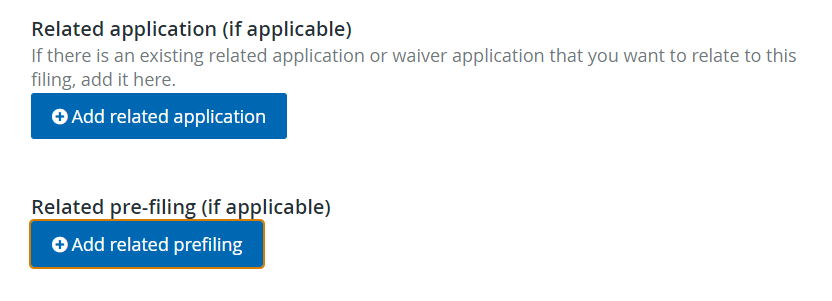

In Ontario pre-filing fees will be credited to the filing. For example, if you pre-file an application or prospectus, the full fee for the application or prospectus is due at the time of filing the pre-file. Once you file the application or prospectus, the fees paid with the pre-filing will be credited towards the application or prospectus filing. Note that you must relate the pre-file to the application or prospectus filing using the search functionality in order to avoid duplication of filing fees. Please note that using the manual linking functionality will result in potentially duplicated fees. Fees paid on a pre-filing submitted through the OSC electronic filing portal will not be credited to the application or prospectus filing on SEDAR+. Contact the OSC for a fee exception code. Read: What are the work arounds to address known fee calculation errors?

How will previously paid fees for pre-filing for a prospectus be applied to an investment fund group prospectus filing?

In Ontario, previously paid pre-filing fees will be applied to or deducted from the prospectus filing fee when exactly the same funds and the same number of funds that have filed the pre-filing have filed the actual prospectus. In Alberta, you will be contacted during the pre-filing review period with instructions on how to request a fee exception code. This will ensure you are not overcharged when filing the prospectus.

Fee calculations

Do I have to manually calculate system and regulatory fees in SEDAR+?

No. When submitting filings subject to system or regulatory fees, SEDAR+ will automatically calculate the fees owing and present the fee breakdown on the ‘Fee summary and payment’ page. In some situations, you may be required to fill in additional fee attributes for the system to calculate regulatory fees appropriately. If you have a question about the details of a fee calculation or whether a fee should have been charged or not, please refer to each jurisdiction’s local fee rules or MI 13-102 for system fees, as applicable. Please contact the respective securities regulatory authority for any outstanding questions.

To understand which documents for your filing(s) will incur a fee, please refer to the Filing Inventory located on the Help Centre.

- WATCH: How to view the Filing Inventory

- WATCH: How to view the Fee Summary

- READ: Filing Inventory

How do I see fees calculated on the filing before submission?

When you select ‘Submit’ on the ‘Review and submit’ page, filings with fees implication will present a fee summary and payment page showing a fee breakdown (per jurisdiction, document and fee type) prior to the submission. You can then select ‘Exit’, ‘Review the filing’ to amend as necessary or select ‘Save’ to save as a draft. Alternatively, after selecting ‘Exit’ you can select ‘Discard the filing’ to completely remove the filing and you will be required to re-create the filing if necessary.

Are all late fees calculated by SEDAR+?

No, certain late fees are not automatically calculated by the system, such as late fees for SEC issuers, SEC foreign issuers, and designated foreign issuers. The securities regulatory authority that received the filing will manually review these filings and create an outstanding fee against the submission, if applicable.

If SEDAR+ will be available 24/7, what timeframe will be used for fee calculation purposes?

For late fee calculation purposes, the date and time a filing is made on SEDAR+ is based on Eastern Time (ET). As such, if a filing is made anytime between 00:00 ET and 23:59 ET, it will be considered filed on that day. For information on the timeframe that will be used for filing review periods see “What timeframe will be used for filing review periods on SEDAR+?”.

As SEDAR+ will be available 24/7, what happens when a filing deadline falls on a weekend or statutory holiday?

The introduction of SEDAR+ won’t change filing deadlines. For example, although SEDAR+ is available 24/7, for the purpose of calculating filing deadlines, in general, a deadline that falls on a Saturday or Sunday, or on a statutory holiday in the jurisdiction where the filing is required, will be extended to the next business day in that jurisdiction. Please note that provinces and territories may have different statutory holidays.

Why is the calculated fee showing as $0.00?

This happens when the fee calculation results in the amount due being less than a previously paid amount. If a refund applies, the system will include instructions for the filer to contact the regulator regarding the fee difference.

Why is the calculated fee showing on the fee summary page incorrect?

Additional fees may be payable when recipient agencies/ jurisdictions are added to an existing filing. For example, when new jurisdictions are added to a filing, filers will have to pay fees for those new jurisdictions.

Why are there fee calculation errors in SEDAR+?

Most fees calculate correctly in SEDAR+ but there are a few fee calculations errors that exist for two main reasons: (1) there isn’t sufficient data in the migrated record to calculate the fee or (2) there are system bugs that could not be resolved before go-live. The fee calculation bugs generally relate to infrequent filings.

What are the work arounds to address known fee calculation errors?

The following general work arounds are in place to address the known errors:

- When the system undercharges fees:

- the recipient agencies will create an outstanding fee in SEDAR+ and contact the filer with instructions for payment. For information on how to search for and view an outstanding fee, click on ‘Search filings with outstanding fees’.

- When the system overcharges fees:

- A fee exception code can be obtained from the CSA Service Desk or the recipient agencies, as indicated in the table below, in advance of making the filing. That exception code is then entered at the time of filing so the system does not charge a fee for that filing. The recipient agencies will then create an outstanding fee in the system for the correct amount and contact the filer to pay the actual fee.

- In certain circumstances, when the fee is calculated exclusively based on the fee attributes entered in the system, the filer can enter “0” (zero) in those attributes. No fee will be charged. The recipient agencies will then create an outstanding fee in the system for the correct amount and contact the filer to pay the outstanding fee.

Known fee calculation errors tables

The following two tables describe each known fee calculation error in SEDAR+, the jurisdictions where the error applies and the actions a filer should take to work around the error. It is possible that other fee calculation errors exist that have not been identified. These tables will be updated if new errors are identified or as errors are resolved.

Fee calculation errors for filings made against migrated filings or that amend filings made outside SEDAR+

| Fee Error ID | Filing type/documents | Applicable jurisdictions | Omission/Calculation error description | Summary of Action to be taken by Filer |

| 1-1 | Take-over bid / Formal issuer bid: Notice of Change or Variation for filings originally filed on SEDAR | NB, NU, QC | Undercharging fees – SEDAR+ will not calculate a fee for the filing of a Notice of Change or Variation of a Take-over bid + Formal issuer bid filings originally filed on SEDAR | Pay the outstanding fees created by the recipient agencies. |

| 1-2 | Report of Exempt Distribution that amends a filing originally filed in paper format (outside of SEDAR, the BCSC e-services or OSC e-portal). | MB, NB, NL, NT, NU, QC, SK, YK | Overcharging fees – SEDAR+ will not consider previously paid filing fees or late fees, where applicable, and will charge fees as though the filing is net new. | • Contact the CSA Service Desk in advance of filing the amended report of exempt distribution and request a fee exception code for each applicable jurisdiction where the filing will be made (see more detail below). • Enter the codes provided by the CSA Service Desk at the time of filing. • Pay the outstanding fees created by the recipient agencies. |

| 1-3 | Report of exempt distribution that amends a filing originally filed in SEDAR or on the OSC e-portal and the amendment results in additional fees owing | MB, NB, NL, NT, NU, QC, SK | Undercharging fees – when the amendment results in additional fees owing, SEDAR+ will not charge the additional fees. | Pay the outstanding fees created by the recipient agencies. |

| 1-4 | Prospectus filings that have a related pre-filing submitted on the OSC electronic filing portal | ON | Overcharging fees – A previously paid pre- filing filing fee should be credited against the filing fee for a corresponding prospectus. SEDAR+ does not deduct the previously paid pre-filing filing fee referenced when filing the prospectus, if that pre-filing was submitted on the OSC electronic filing portal and not through SEDAR+. | Contact the OSC in advance of the filing and request a fee exception code. Enter code at the time of filing. |

Fee calculation errors for new filings made on SEDAR+

| Fee Error ID | Filing type/documents | Applicable jurisdictions | Omission/Calculation error description | Summary of Action to be taken by Filer |

| 2-1 | Applications, pre-filings and waiver applications | ON | Undercharging fees – When a filing is made for more than one profile, additional fees may apply if either; The filing is made by or on behalf of two or more investment funds that do not have the same investment fund manager. The filing is made by or on behalf of two or more investment fund managers that are not affiliated with each other. SEDAR+ will only charge a filing fee for the applicant under which the filing was initiated. | Pay the outstanding fee created by the OSC. |

| 2-2 | Prospectus pre-files under CSA SN 43-310 | AB | Overcharging fees – SEDAR+ will incorrectly charge a filing fee in Alberta for prospectus pre-files under CSA SN 43-310. | Contact the ASC in advance of filing the 43- 310 pre-filing and request a fee exception code. Enter code at the time of filing. |

| 2-3 | Pre-filings related to a prospectus under NP 11-202 | AB, BC, MB, NB, NS, ON, QC, SK | Undercharging fees – SEDAR+ currently does not charge a system fee for any prospectus pre-filings. This is correct for prospectus pre-files under CSA SN 43-310, but not correct for pre-filings related to a prospectus under NP 11-202. | Pay the outstanding system fee created by the CSA Service Desk. |

| 2-4 | Prospectus filings that have a related pre-filing | AB | Overcharging fees – A previously paid pre- filing filing fee should be credited against the filing fee for a corresponding prospectus. SEDAR+ does not deduct the previously paid pre-filing filing fee when the pre-filing is referenced when filing the prospectus. | You will be contacted by the ASC during the pre-filing review period with instructions on how to request a fee exception code. |

| 2-5 | Amended and restated prospectus filings by a subset of all funds in the group | AB, QC, NB, MB, NL, NS, NT, PE, SK, YK, NU (i.e. impacts all jurisdictions except ON and BC) | Overcharging fees – For Investment fund groups filing an ‘Amended & restated’ prospectus, only IFs subject to the amendment should be charged an amendment fee, however all Investment funds will be charged. | Contact the CSA Service Desk in advance of filing the amended and restated prospectus and request a fee exception code for each applicable jurisdiction where the filing will be made (see more detail below). Enter the codes provided by the CSA Service Desk at the time of filing. Pay the outstanding fees created by the recipient agencies. |

| 2-6 | Report of Exempt Distribution filed late, and the late period is longer than 20 days and extends beyond March 31. | NB | Undercharging fees – In NB SEDAR+ will incorrectly charge a maximum late fee of $1,000 per report of exempt distribution, instead of $1,000 per report, per year, where the year begins on April 1 and ends on March 31. | Pay the outstanding late fee created by the FCNB. |

| 2-7 | Prospectus: Combination subtypes – Preliminary and amendment to preliminary, Final and amendment to final and Combined preliminary and pro forma, and amendment to preliminary (New Subtypes) | AB, BC, QC, NB, MB, NL, NS, NT, PE, SK, YK, NU (i.e. impacts all jurisdictions except ON) | Overcharging fees – When there is more than one instance of using the New Subtypes to add a fund or jurisdiction to the filing, the system does not recognize that a fund or jurisdiction previously added using the same subtype is not new and incorrectly charges that fund or jurisdiction the ‘preliminary’ or ‘final’ fee, instead of the ‘amendment’ fee. | Contact the CSA Service Desk in advance of filing the amended and restated prospectus and request a fee exception code for each applicable jurisdiction where the filing will be made (see more detail below). Enter the codes provided by the CSA Service Desk at the time of filing. Pay the outstanding fees created by the recipient agencies. |

Viewing payments

Where do I find the fees and transactions submitted for a filing?

The ‘View basket’ page includes details of the associated fees and any transactions (i.e. payments and refunds) that have been created. For more information, click on the following link to View basket and basket transactions.

Where can I view the fee attribute information that was submitted with a filing?

The fee attribute information for a specific submission in a filing can be viewed by clicking on the desired submission number in the ‘submissions’ section of the filing.

Last updated on: November 24, 2025