Continuous Disclosure

General

Can I file a different pdf document for each investment fund in the group under the same filing number if the document type is the same?

Yes. To file a different document for each fund in the group under the same filing number you need to create the filing and upload the document for one investment fund in the group. After submitting the filing, search for that created filing, click on ‘Actions,’ click ‘Maintain <document name>,’ and then upload the second document for the second investment fund. Repeat this process until all the documents have been uploaded against the same filing for each respective investment fund in the group.

This process applies to any continuous disclosure filing, other than MRFP, where you want to submit a different document for each fund under the same filing number when the document type is the same.

Where do I file voting results?

As per National Instrument 51-102 Continuous Disclosure Obligations, a reporting issuer that is not a venture issuer should file a report of voting results promptly following a meeting of security holders at which a matter was submitted to a vote. The report should be filed under the filing type ‘Management Proxy Materials’ using the document type ‘Report of voting results’.

Can I make XBRL filings on a voluntary basis through SEDAR+?

SEDAR+ does not accept filings in XBRL format.

Where do I file documents relating to going private transactions and related party transactions that do not fit into a specific filing type?

In certain jurisdictions, there are special filings required in connection with going private transactions and related party transactions. To the extent applicable, a document relating to a going private transaction or a related party transaction should be filed under the filing type appropriate to the document. For example, a notice of meeting, a management proxy/ information circular and form of proxy relating to a going private transaction or a related party transaction would be filed as ‘Management Proxy Materials’ located under the ‘Continuous Disclosure’ category. If there is no other applicable filing type for the particular document, then the document should be filed under ‘Other’ with an appropriate description included, and the filer must send a request to the principal regulator to turn the document from ‘Private’ to ‘Public’.

Do the documents related to a CPC qualifying transaction have to be filed in SEDAR+?

Yes, a new filing type has been created specifically for CPC qualifying transactions. The new filing type can be found under the Continuous Disclosure category of filing. All documents will be kept private unless a document is turned public by a Regulator or on demand by the Filer.

Where do I file a news release that relates to a normal course issuer bid?

All news releases related to a normal course issuer bid must be filed under the filing type ‘Exempt issuer bid’, from the ‘Third party filings and securities acquisitions’ section, since the calculation of the fees is tied to this filing.

Where do I file a notice of exemption required under section 2.11(c) of NI 81-106 for investment fund non-reporting issuers?

Notice of exemption required under section 2.11(c) of NI 81-106 for investment fund non-reporting issuers must be filed under the filing category ‘Continuous Disclosure’ and filing type ‘Annual financial statements-non-reporting issuers’ or ‘Interim financial statements/reports – non-reporting issuers’, as applicable. The Notice is filed for each fund. If a fund profile is part of a group, the selection to file the Notice will not be available. Remove the fund from the group before filing the Notice. You can add the fund back to the group after filing the Notice, if preferred.

What financial period ended date should I enter when filing a Notice of exemption (section 2.11(c) of 81-106)?

As the ‘financial period ended’ date is currently a required field on SEDAR+, you should enter today’s date.

A future release of SEDAR+ will require a date only if you are submitting a financial statement document.

How can I avoid paying late fees on a voluntary Q4 interim financial statement filing?

If you are filing a voluntary Q4 interim financial statement, late fees are not applicable. Please contact the CSA Service Desk to request fee exception codes from jurisdictions where there are late fees for an interim financial statement (‘Impacted Jurisdictions’). Please see ‘What is a fee exception and how do I request a fee exception code?’ for guidance on how to request for fee exception codes.

Participation fee forms

How can I submit a participation fee form for Alberta and/or Ontario?

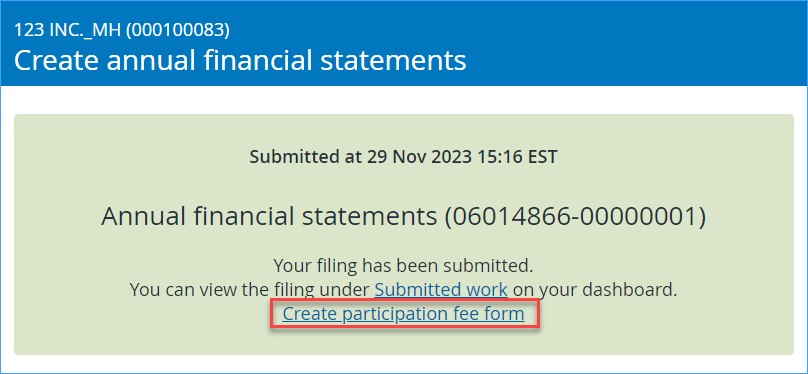

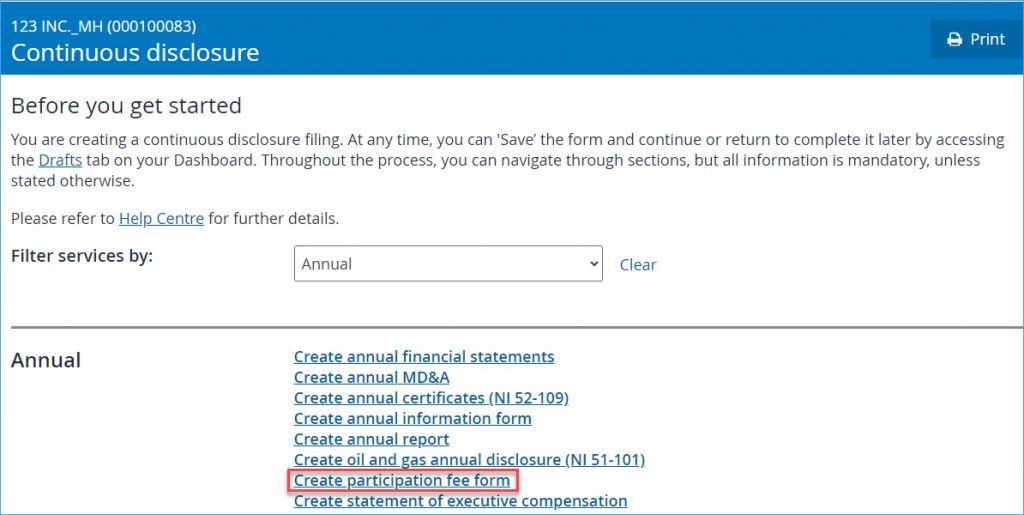

Select ‘Yes’ to the question ‘Are you required to file a participation fee form in Alberta and/or Ontario?’ when creating your annual financial statement filing. In contrast to other filings, after submitting your annual financial statement and completing payment, the confirmation page provides a link to ‘Create participation fee form’. This link displays only if the recipient agency is Alberta and/or Ontario, on the ‘Filing and contact details’ page.

Alternatively, simply select ‘Participation fee form’ from the ‘Annual’ sub-menu, under the Continuous Disclosure sub-menu.

Do I need to submit separate participation fee forms for Alberta and Ontario?

No. You only need to complete one form in SEDAR+ and the system will create one pdf form for Alberta and one pdf form for Ontario.

I am not a reporting issuer in Alberta, how do I file the participation fee form only in Ontario?

When you select only Ontario as the recipient agency, the participation fee form will be created and filed only in Ontario.

How can I submit a participation fee form if I do not have data for the 1st specified trading period or quarterly trading period? For example, an issuer who was not trading in the first three quarters of the year but then started trading in the fourth quarter?

You should enter the information from the first quarter or period, in which the issuer was trading, into the 1st “specified trading period or quarterly period” section of the participation fee form. For example, If the issuer didn’t start trading until the fourth quarter of the year, the fourth quarter information should be entered into the section for the first quarter. This information should only be entered once. It should not be re-entered into the fourth quarter section.

How can I submit Form 13-501F1 / 13-502F1 participation fee forms if it only has debt securities listed?

The SEDAR+ system does not allow a filer to submit the participation fee form with debt security only information. The filer is required to enter an equity symbol and quarterly period information even though this information is not applicable. As a workaround, please inform the Regulator that this type of filing is required. You will be instructed to complete a PDF of the participation fee form and file it on SEDAR+ using the ‘Annual financial statements – other’ filing type. The participation fee form submitted under this document type will be auto-public on SEDAR+. The Regulator will create an outstanding fee, as applicable.

Is the participation fee for specified regulated entities also submitted in SEDAR+?

No. Specified regulated entities will not be included as part of SEDAR+ Phase 1. Form 13-502F7 should continue to be filed in Ontario through the OSC electronic filing portal and Form 13-501F7 should continue to be filed in Alberta by mail or email.

How do I maintain/correct a previously filed participation fee form?

You cannot maintain/correct a previously filed participation fee form. You must create a new filing and re-enter the information. You will need to request for a fee exception or pay the fees again and request a refund afterwards. For more information on requesting a fee exception, click on the following link to View Fees, Payments, and Refunds.

Generally Class 2 Reporting Issuers who estimated its capitalization on the ‘AB Form 13-501F2 and/or ON Form 13-502F2’ would file the adjustments of fee payment through the ‘AB Form 13-501F3 and/or ON Form 13-502F2A’.

Is there a participation fee form for investment funds?

The participation fee form for investment funds is applicable in Alberta only. In order to submit Form 13-501F5, only Alberta should be selected as the recipient agency.

How can I submit participation fee forms for multiple investment funds in a group?

To file the form for multiple funds in a group, you should initiate the filing from the investment fund group profile. You’ll be given the option to select all investment funds applicable to the filing or to customize the filing by selecting a subset of funds.

How should a Class 2 reporting issuer with a net deficit at the end of the financial year file the participation fee?

A Class 2 reporting issuer must file a completed Form 13-501F2 in Alberta and/or the Form 13-502F2 in Ontario. Deficits should be entered as negative amounts in the participation fee form for the system to correctly calculate the participation fee.

Does a reporting issuer that is a subsidiary entity and exempt from paying fees need to file a participation fee form?

Yes. Each year the company should verify if the company has more than 90 percent of both net assets and gross revenues of the parent, or if the subsidiary is entitled to rely on an exemption or waiver from the requirement. These calculations should be submitted through SEDAR+ using the Subsidiary Exemption Notice Form 13-501F6 or Form 13-502F6.

Annual/Interim filings

Where should I file the Annual Financial Statements or Interim Financial Statements/Report for Non-Reporting Issuers?

For non-reporting issuer mutual funds, these should be filed under the filing types of ‘Annual Financial Statements – Non-Reporting Issuers’ or ‘Interim Financial Statements/Report – Non-Reporting Issuers’ under the continuous disclosure category. Using these filing types will not trigger the annual filing system fee.

For non-reporting issuer companies or non-redeemable investment funds that are required to file annual financial statements under the offering memorandum exemption, the annual financial statements should be filed under the filing type of ‘Annual Financial Statements – Non-Reporting Issuers’ under the exempt market offerings category.

Can I create one MRFP filing for all funds within an investment fund group?

No, a separate MRFP filing must be created for each fund. There will be a link ‘Create MRFP filing for another investment fund in the group’ on the confirmation page after the filing is submitted that will take you to create a new MRFP for another fund.

If I prefer to file a separate annual or interim financial statement document for each investment fund in the group instead of one consolidated document, is there functionality to assist the filing under the same filing number?

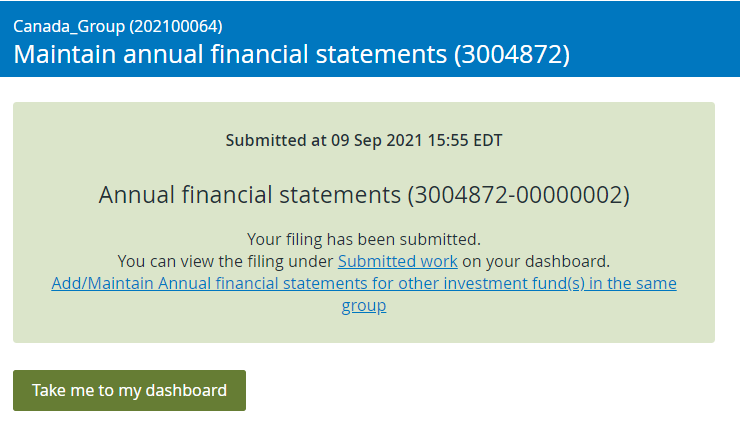

Yes. For example, to file an annual financial statement for an additional fund in the group under the same filing number, go to the confirmation page in Maintain Annual Financial Statements and click on the link ‘Add/Maintain annual financial statements for other investment fund(s)’ in the same group (see screenshot below).

This link navigates you to upload another annual financial statement document for a second fund in the group. This process can be repeated for as many funds in the group as desired under the same filing. A similar feature exists when making an interim financial statement filing.

Last updated on: July 24, 2025